The private markets are more crowded and competitive than ever. In fact, PitchBook tracks over 25,000 PE firms and more than 57,000 VC firms—a number that has grown exponentially over the past decade. With so many options on the table, choosing the right fund manager to partner with can be difficult. PitchBook’s best-in-class private market data and industry research empower investment professionals with the information they need to mitigate risk. More specifically, our timely, actionable insights enable limited partners to find the right firms to work with, invest smarter, and ensure their capital is safe.

Private market risks and challenges

One of the biggest challenges capital market professionals face is understanding the array of investment strategies deployed by fund managers. This can be particularly challenging in the private markets where data and insight to inform decision-making has traditionally been scant. When seeking transparency into fund managers and levers that may impact their returns, asset allocators can struggle to:

Discern fund manager investment strategies

Quickly and easily evaluate exposure and fit

Understand how an investor's style has shifted over time

View broad levers deployed by fund managers to build a portfolio

Additionally, extended investment time horizons mean that the LP/GP relationship is continuing to lengthen—increasing from the textbook 10-12 years to 15-18 years in many cases. Given the longevity of this unique working relationship, selecting the right fund manager is an important decision with serious implications.

The right fund manager

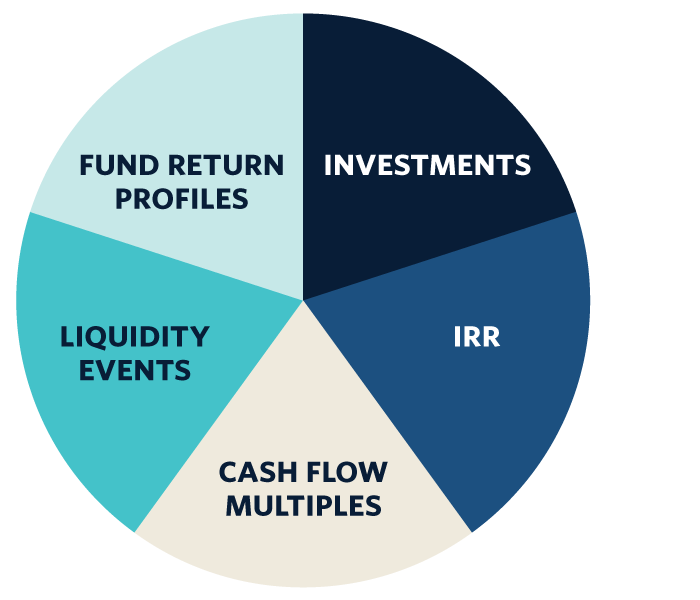

Access to data like fund return profiles, investments, IRRs, cash flow multiples, and liquidity events can illustrate a general partner's true strengths and weaknesses—and allow you to be more strategic in your manager selection process.

PitchBook's guide to overcoming four allocator workflow challenges

Learn how LPs can use data-driven insights to uplevel their investment strategies—with trusted research, benchmarks, and portfolio allocation tools.Download the guide

How data can help you find a fund manager

PitchBook’s robust private market data and insights make it easy to conduct fund manager due diligence and remain confident in your investment strategy, despite the competitive environment. Our customers have access to a wealth of information that can be used prior to making a commitment to ensure a fund manager has generated value in the past.

When choosing a fund manager, every detail matters. If you haven’t seen all of a GP’s past investments, then you aren’t getting the full story. Access to data like fund return profiles, investments, IRRs, cash flow multiples, and liquidity events can illustrate a general partner’s true strengths and weaknesses—and allow you to be more strategic in your manager selection process. Knowing if a manager drove growth across their entire portfolio or if they capitalized on the success of one unicorn might change your mind.

Full story

Access to data like fund return profiles, investments, IRRs, cash flow multiples, and liquidity events can illustrate a general partner's true strengths and weaknesses.

About PitchBook’s investment style summary feature

PitchBook’s investment style summary is a proprietary analysis feature that helps LPs assess the selection of a fund manager. The feature gives PitchBook customers access to a high-level summary of a fund manager’s investment style and historical preferences across four categories—industry, geography, deal type, and deal size. The investment style summary feature can provide meaningful insights for questions like:

- What is a fund manager’s overall investment philosophy?

- Is this fund manager a generalist or a specialist in terms of the industries they invest in?

- Are they focused on regional or global investments?

- Have they historically focused on large, medium, or small investments?

- Does their investment history align with how they’re positioning a new fund?

More PitchBook data to leverage when selecting a fund manager

To support the growing fund manager due diligence process, PitchBook has also expanded datasets on GP person profiles within the platform. These data sets provide additional transparency—key for LPs making asset allocation decisions. These data sets include:

- Affiliated funds:

Displays IRR and quartile performance data on each fund associated with a GP, along with easy access to deeper report drill downs. - Analytics:

Provides a holistic view of a deal track record, based on LP deals and affiliated funds. - Board seats:

Lists current and past board seats held by GPs, along with tenure, to showcase fund manager experience and track record. - Closed funds, previous investments and liquidity events:

To fully understand a GP’s track record, you need to see their previous funds and investments. Dig into data on investments, deal multiples, returns, liquidity events, and more. - Fund returns:

PitchBook publishes which GP or LP reported a return figure—and when. See specific return profiles for various LPs in the same fund. - Lead partners on deals:

Lists deals involving GPs as lead partners, detailing investment exposure and industry focus area. - Limited partners:

See how often LPs have recommitted to a GP’s subsequent funds. - Open funds:

See what funds are in the market now with details including fund type, size, vintage, and location. - Professional network:

Includes a GP’s professional network across firms and fund team members, board members, and portfolio executives. - Team:

When evaluating a fund manager, see whether they’ve created value throughout their career—not just at their current firm. PitchBook’s people profiles let you track individuals with deal and fund attribution.

A streamlined approach to manager selection

If you are looking for insight into fund manager performance at a glance, PitchBook’s Manager Scoring can be a helpful starting point. While our Capital Call and Distribution Speed Scores are not meant to replace extensive due diligence, they can save time when evaluating potential managers for selection. You can easily discover top fund managers to add to your shortlist—and determine whether those managers are likely to have faster capital calls and distributions than their peers. Learn more about how we score fund families in this recent report.

How better data can make better benchmarks

Another way better data has changed how LPs and private market professionals approach investing is the potential for custom benchmarks. Benchmarks have always been important for measuring and reporting fund performance—but there is only so much they can tell you. Traditional benchmarks only include basic criteria like vintage year, fund type, fund size, and location. By layering in additional levels of detail to these performance measurement tools, it’s possible to better differentiate and understand the value of a fund. Having the ability to compare a fund to others that have actually made similar investments is game changing.

“We use PitchBook for better due diligence—as well as market insights, research, and benchmarking data. Another win: our deals and funds can also be found on PitchBook, which helps promote our firm to others doing research.”

—Kevin Barber, Managing Director, Sun Mountain Capital

Seeing which investments a fund has made means that you can better understand a fund manager’s track record and put their returns in perspective by comparing it to a more accurate peer group. And when you can connect the success or failure of a fund’s investments to its overall performance, you can see what is driving a fund’s returns.

Ultimately, should funds focused on different industries be compared in the same benchmark? Does it make sense to compare energy to IT? Or fintech to manufacturing? In the end, the level of data that traditional benchmarks provide on the private markets provide gives some insight—but introducing industry and company data can help better classify and compare performance than traditional benchmarks allow.

More on fund management

Discover the top-performing fund families across ten strategies

Download our Global Manager Performance Score League Tables report

What should you evaluate beyond IRR?

Explore An LP’s Guide to Manager Selection

How can you more effectively vet companies and investors?

Check out our blog post on key questions to consider when vetting companies and investors

Ready to explore PitchBook’s global private equity data? Request a free trial Already a PitchBook customer? Log in.