The 2008 Global Financial Crisis marked a period of decline across the capital markets, when exit value and public listings fell precipitously. But despite these challenges, corporate M&A and investment activity during that era remained resilient by comparison—based on a variety of factors at play, including record capital on corporate balance sheets.

In a recent report highlighting corporate venture capital (CVC) during economic downturns, PitchBook analysts say we’re seeing similar resiliency amid the present-day slump. In the Q1 2023 Analyst Note, PitchBook VC Analyst Vincent Harrison reports that 26.2% of all US VC rounds in 2022 included a CVC investor—the highest proportion of overall US VC deal count ever observed for CVC deals.

But what is corporate venture capital, how is it different from institutional venture capital, and what are the top CVC firms? We dig into these questions and more in this blog post.

What is corporate venture capital?

Let’s start at the top. Venture capital is a form of financing where capital (aka money) is invested into a company—usually a startup or small business—in exchange for equity in that company. In venture capital, this equity is often a minority stake, 50% ownership or less of the company where capital is invested. With that figure as our basis, let’s look more closely at traditional vs. corporate VC—two distinct approaches to venture capital.

How is corporate venture capital (CVC) different from traditional venture capital?

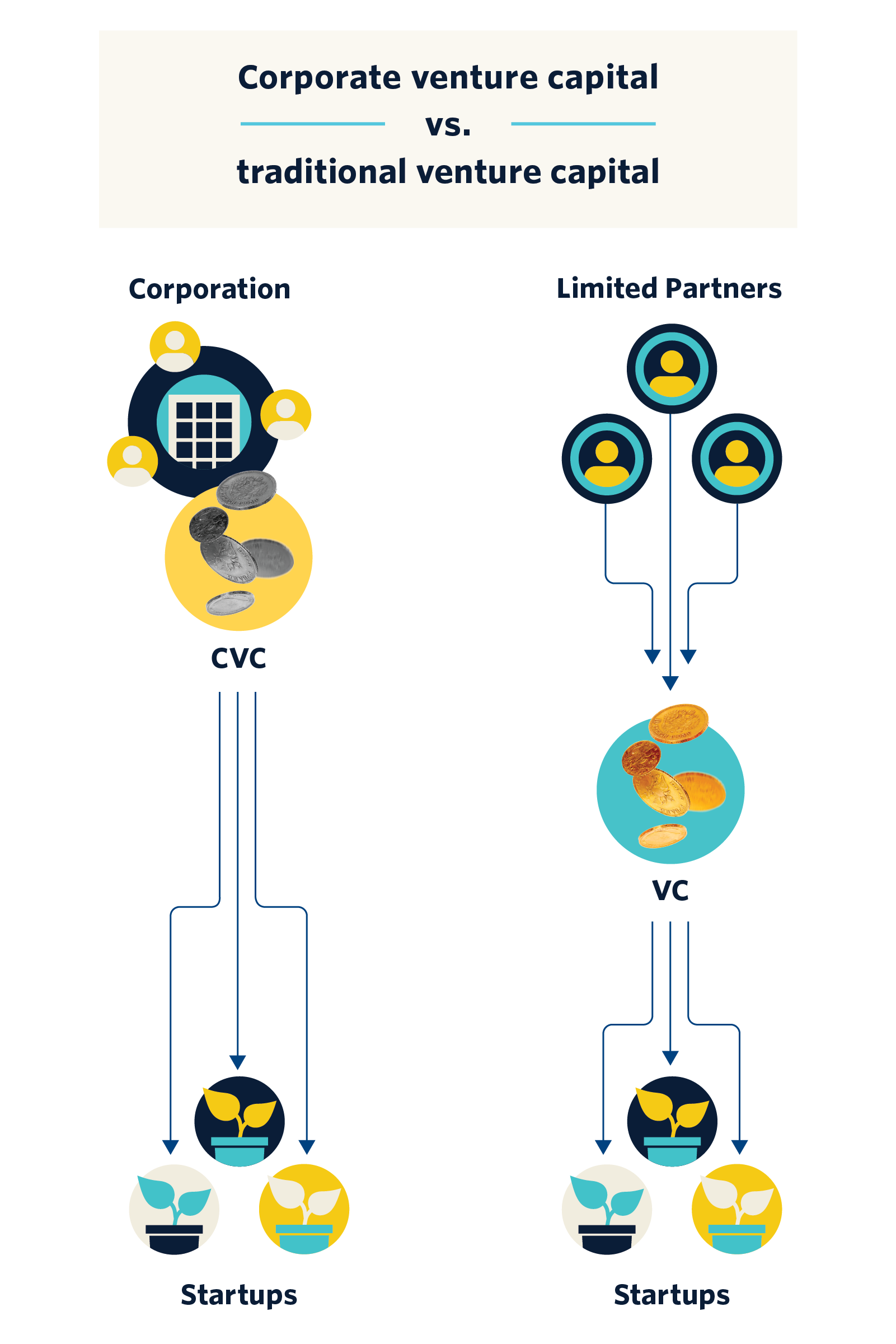

Traditional VC firms raise capital from limited partners, pool that money to create VC funds, and leverage those funds to provide startups with high-risk (and potentially high reward) financing in exchange for equity. The primary goal for traditional venture capitalists, also called general partners (GPs), is to achieve outsized financial returns through well-executed investments. Typically, 80% of those returns go back to the limited partners, while GPs retain 20% in the form of carried interest and management fees.

Corporate VC firms, on the other hand, usually sit within the structure of a large, established company—we’ll look at some of the major players more closely below. Many CVC firms draw money from their parent company for their operating budget, and CVC teams—unlike traditional VCs—are looking for more than just financial returns on their investments.

What is the primary objective of CVC?

When they invest, CVC firms are looking for a strategic advantage. Aiming to stay ahead of the shifts and turns in an evolving industry or market, CVC firms are looking for intel—which can come in many forms—that will ultimately help their parent organization maximize its bottom line. As the VC arm of a larger corporation, CVC firms look for financial returns and opportunities to:

- Build up their industry expertise and expand offerings

- Enter new markets

- Create ripe, new spaces for innovation

- Become involved in the development of new and expanded technologies

- Access new resources

- Identify potential acquisition targets

What are the top CVCs by number of investments? (2018-present)

The following CVC firms are listed in order of the total number investments they’ve made over the past five years, according to PitchBook Platform data as of June 9, 2023. Note that investment data changes often—potentially day-to-day—so this information represents a snapshot in time. For the latest, most up-to-date CVC investment data, log into the platform, do an investors search, and set “investor type” to corporate venture capital.

1. GV

Founded: 2009

Investments: 472

HQ: 📍Mountain View, CA

Median round amount: $22.7M

AUM: $8B

As the corporate venture arm of Alphabet, Google’s parent company, GV seeks to invest in technology and media sectors. Founded in 2009 and based in Mountain View, CA, the firm has invested in companies like ClassPass, Lola.com, Brandless, and theSkimm. Most recently, in June 2023, GV invested in the early-stage VC, Series A funding round of Palo Alto-based Bitterroot Bio, a biotech startup that develops and delivers therapies for patients with cardiovascular disease.

2. Salesforce Ventures

Founded: 2009

Investments: 459

HQ: 📍San Fransisco, CA

Median round amount: $19.2M

AUM: $5B

Salesforce Ventures is the CVC arm of San Francisco-based enterprise cloud computing company Salesforce. Founded in 2009, and with an active portfolio of 332 investments, the firm invests in cloud-based companies and startups within the broader tech sector. Most recently, in June 2023, Salesforce Ventures participated in the later-stage VC, Series C funding round of Toronto’s Cohere, the developer of a natural language processing software.

3. Tencent Investment

Founded: 2011

Investments: 435

HQ: 📍Shenzhen, China

Median round amount: $24.8M

AUM: N/A

Tencent Investment is the corporate venture arm of Tencent Holdings, a Chinese multinational tech and entertainment conglomerate—and one of the highest-grossing multimedia companies in the world. The firm most often invests in wireless internet, new media, online gaming, social gaming, and e-commerce startups. They’ve got an active portfolio of 489 investments, and their most recent financing round was a joint venture between Tencent Investment and China Unicom in April 2023.

4. Coinbase Ventures

Founded: 2018

Investments: 423

HQ: 📍San Francisco, CA

Median round amount: $8.6M

AUM: N/A

As the CVC arm of San Francisco’s Coinbase, Coinbase Ventures tends to invest in early-stage cryptocurrency and blockchain technology companies. With an active portfolio of 363 investments, the firm most recently invested in the early-stage VC, Series A funding round of Delaware’s Alluvial Finance, the developer of enterprise-grade liquid staking protocols that integrate digital assets into institutions’ portfolios.

5. Eight Roads

Founded: 1969

HQ: 📍Hamilton, Bermuda

Investments: 328

AUM: $11B

Founded in 1969, Eight Roads is a venture arm of Fidelity International based in London. The firm, which has an active portfolio of 282 investments, tends to pursue opportunities within the healthcare and broader technology sectors. In April 2023, Eight Roads and others sponsored Sun King during its acquisition of PayGo Energy for an undisclosed amount.

PitchBook for corporate venture capital

To stay ahead in the evolving capital market landscape, corporate venture capital teams need best-in-class insights into the flow of capital across the entire VC, PE, and M&A landscape. PitchBook provides detailed data on the private and public markets, including key information on companies, investors, funds, investments, and more. Our data, insights, and research can support CVCs as they develop their strategies, evaluate opportunities, and monitor their competitors.

| EBOOK PitchBook for corporate venture capitalLearn how CVC teams can leverage PitchBook to help execute their growth strategies and make more informed investment decisions. |

What PitchBook’s CVC clients are saying

| CUSTOMER STORY See how PitchBook helps Stableton Financial act swiftly on opportunities to create advantages for investors |

Ready to explore PitchBook? Log in.

Not a PitchBook user yet? Request a free trial.